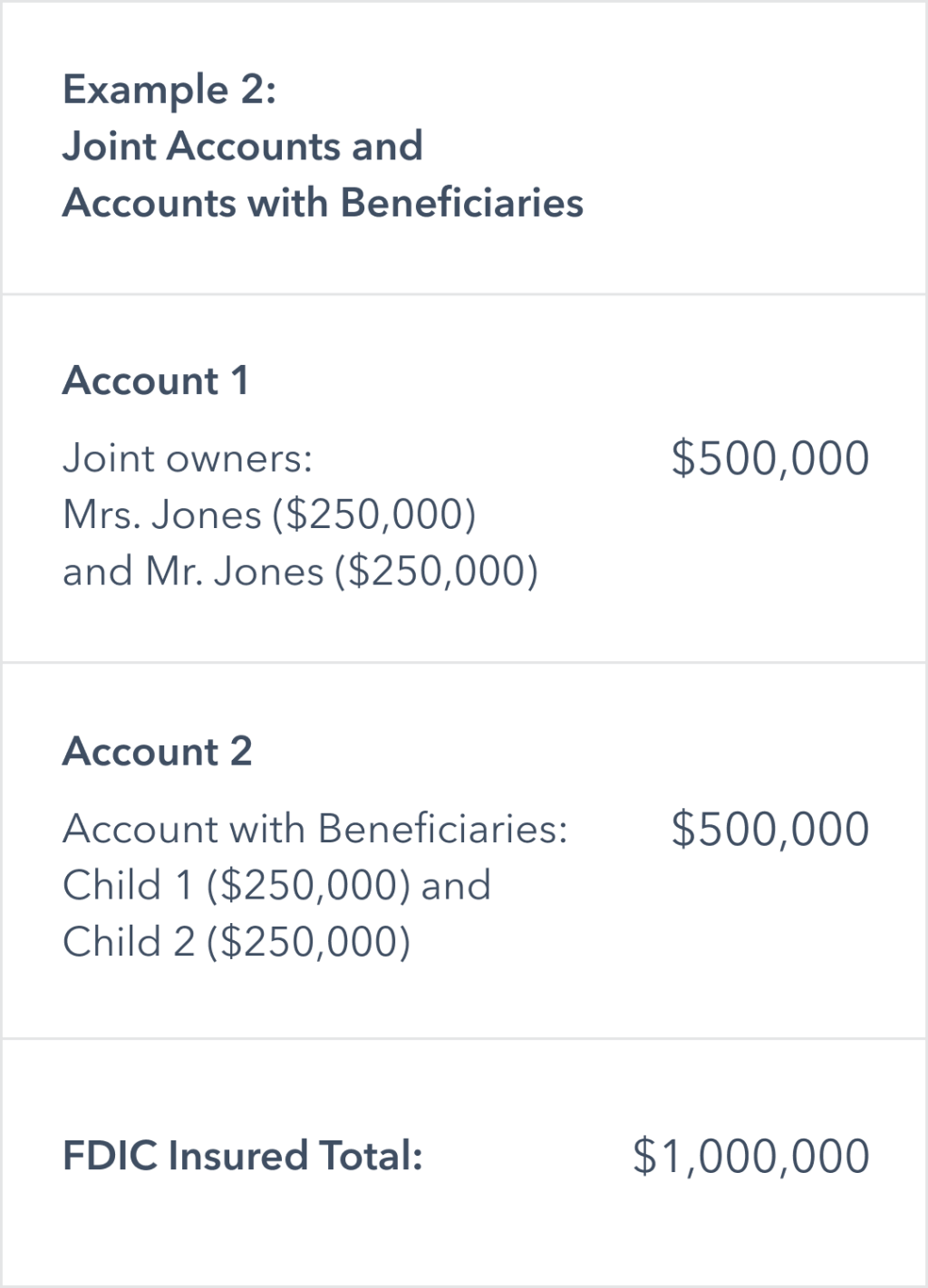

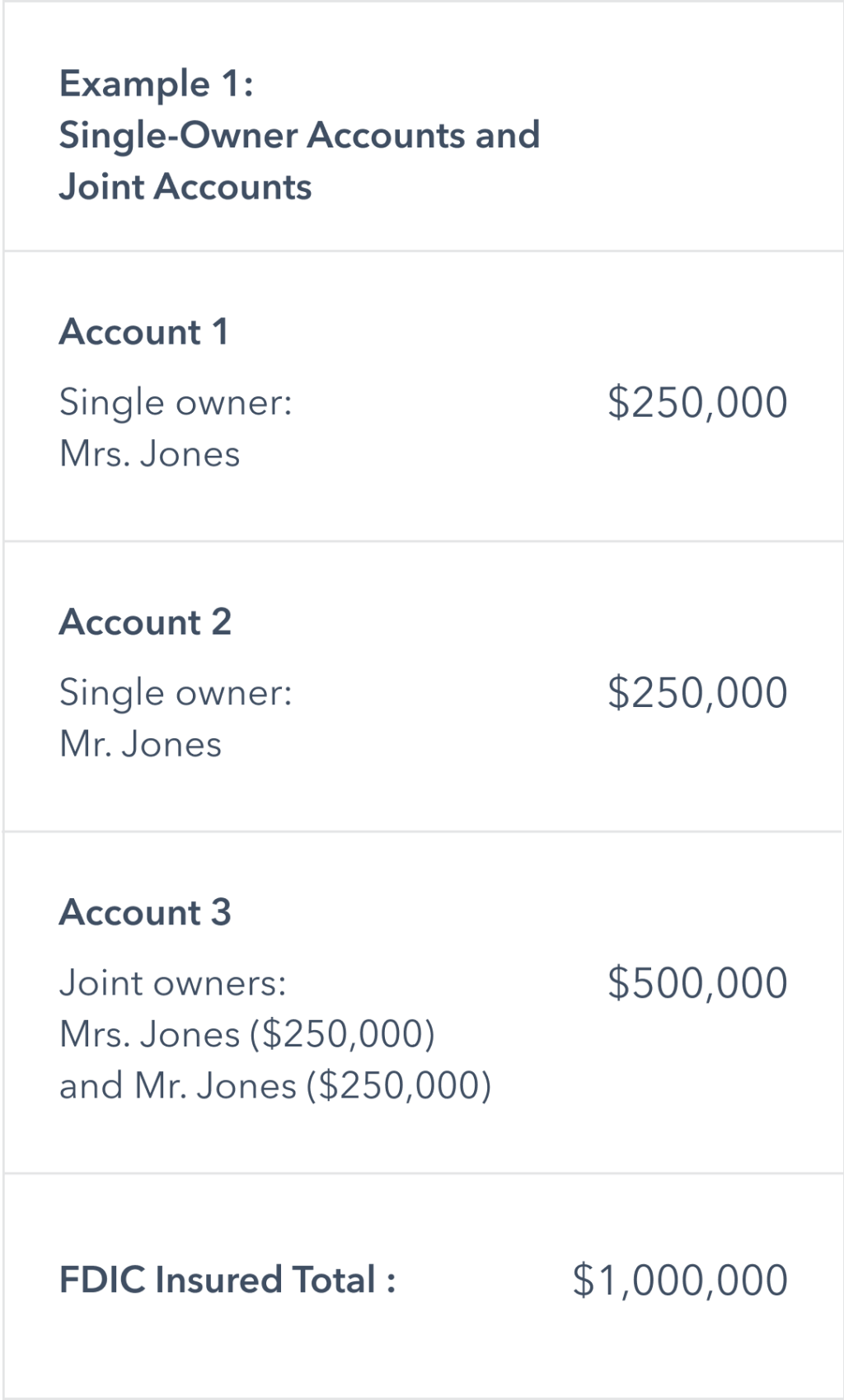

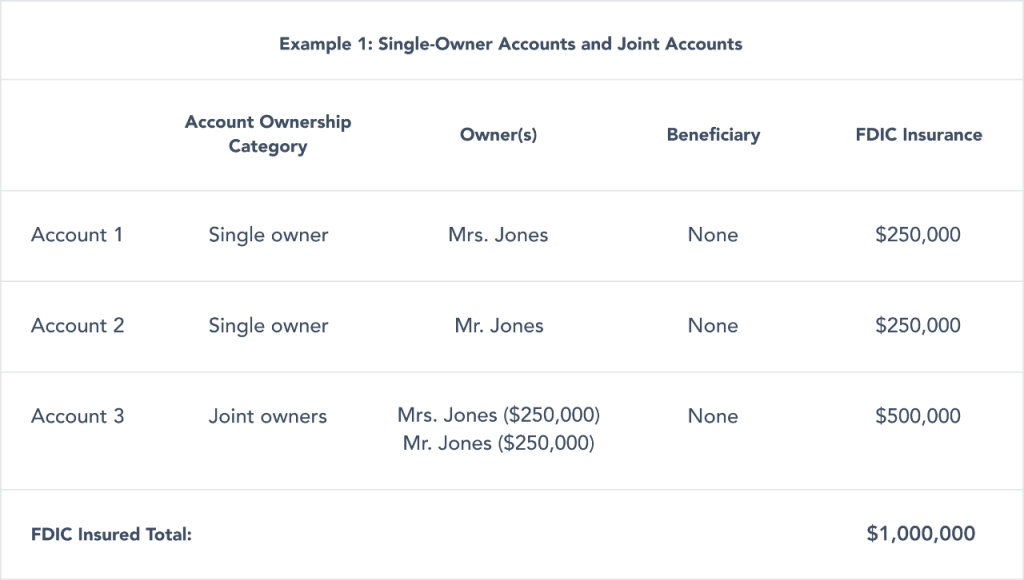

Offer helpful instructions and related details about Fdic Coverage Calculator - make it easier for users to find business information than ever. If a married couple spreads their deposits across multiple American Express Savings accounts as both individual and joint owners they can increase their FDIC coverage from up to 250000 each to up to 1M between them.

Fdic Seminar On Deposit Insurance Coverage For Bankers Advanced Ppt Download

In the unlikely event that your bank.

. This may give you some peace of mind as to the safety of your regular accounts. June 16 2009. Understanding the deposit insurance coverage you have on your accounts.

If you find that your coverage is insufficient speak with your. This amount includes principal and accrued interest through the banks closing date. California drivers can choose to skip the state minimum insurance requirements if they use an approved alternate type of financial responsibility including a.

As long as your financial institution is insured by the FDIC which insures bank accounts or NCUA which insures credit union accounts the coverage limits available from either federal agency will be the same which is currently 250000 per depositor per financial institution not per branch location. So you can get two three or four times the FDIC coverage by simply opening multiple accounts. Up to 25 cash back By Monica Steinisch.

The result generated by the eCalculator is just an estimate of your insured deposit and may not be saved when you exit the eCalculator. 1 day agoFor the final 6 months of 2022 the standard mileage rate for business travel will be 625 cents per mile up 4 cents from the rate effective at the start of the year. Remember FDIC coverage is per depositor per bank.

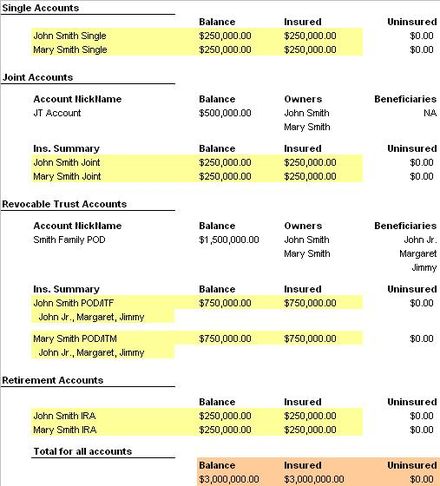

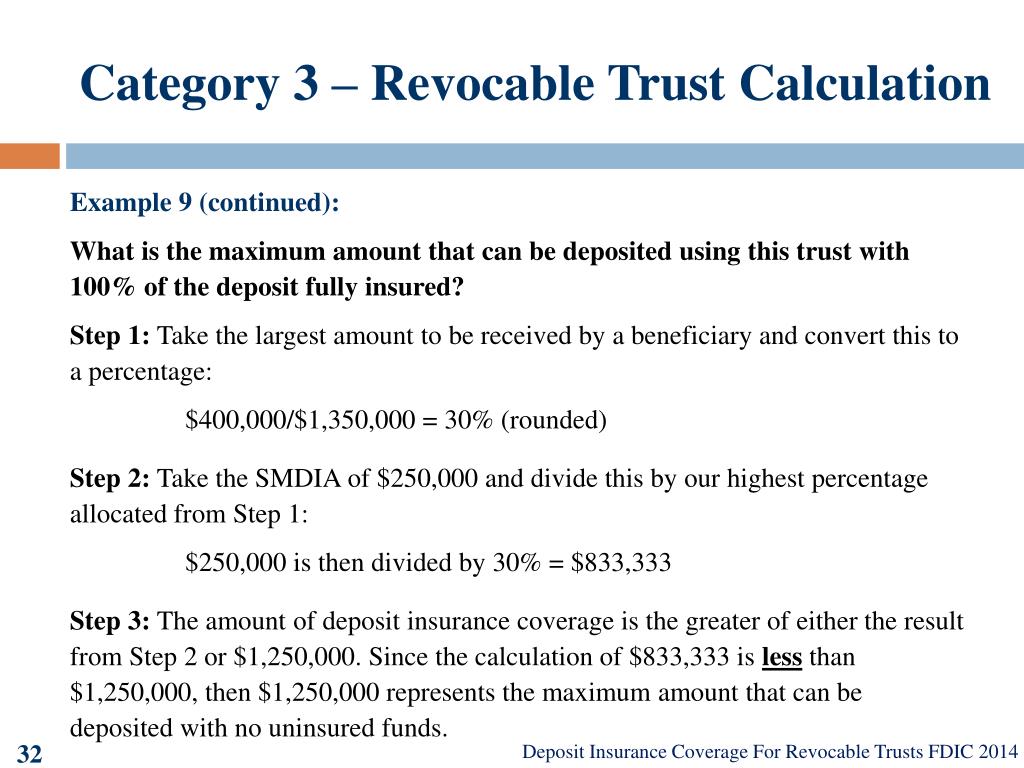

EDIE allows consumers and bankers to calculate your coverage on a per-bank basis determine how much is insured and what portion of your funds if any exceeds the. To get started please click on the link below and follow the instructions provided by. Since the FDIC insurance limit of 250000 is per ownership category at each bank you can easily maximize your coverage in one of two ways.

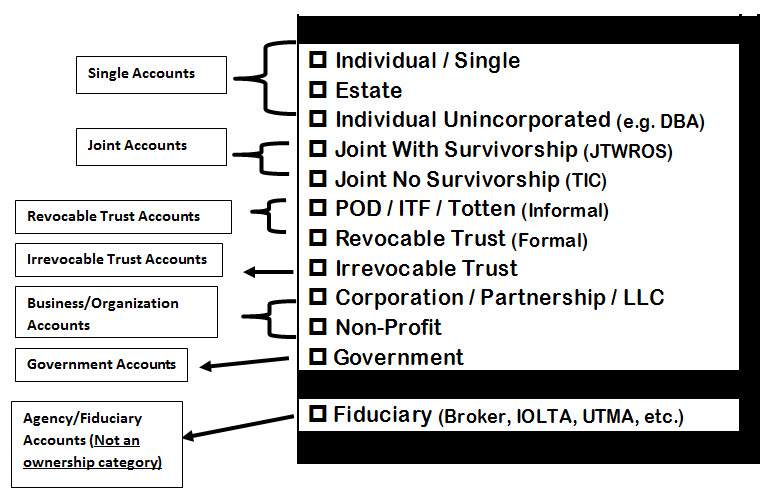

The FDIC protects consumers in the event of a bank failure offering up to 250000 in insurance coverage for each ownership category. You can also call the FDIC at 877 275-3342 or 877 ASK-FDIC. That means that the insurance limits are applied to the combined balances.

To determine your deposit insurance coverage or ask any other specific deposit insurance questions please visit the FDIC Information and Support Center or call 1-877-ASK-FDIC 1-877-275-3342. Welcome to the Deposit Insurance eCalculator an interactive tool that helps estimate your insured deposits in member-banks of PDIC. EDIE lets consumers and bankers know on a per-bank basis how the insurance rules and limits apply to a depositors specific group of deposit accountswhats insured and what portion if any exceeds coverage limits at that bank.

The standard insurance amount is 250000 per. For example if you have 300000 in bank deposits you could open two bank accounts putting 150000 in each. Elliott Insurance Topeka Ks.

Note that coverage is calculated per bank not per account. This calculation is based on the deposit insurance regulations in effect as of July 2011. EDIE also allows the user to print the report for their records.

EDIE lets consumers and bankers know on a per-bank basis how the insurance rules and limits apply to a depositors specific group of deposit accountswhats insured and what portion if any exceeds coverage limits at that bank. First you can deposit your money at different banks. Currently the basic FDIC insurance limit is 250000 per depositor account holder per insured bank.

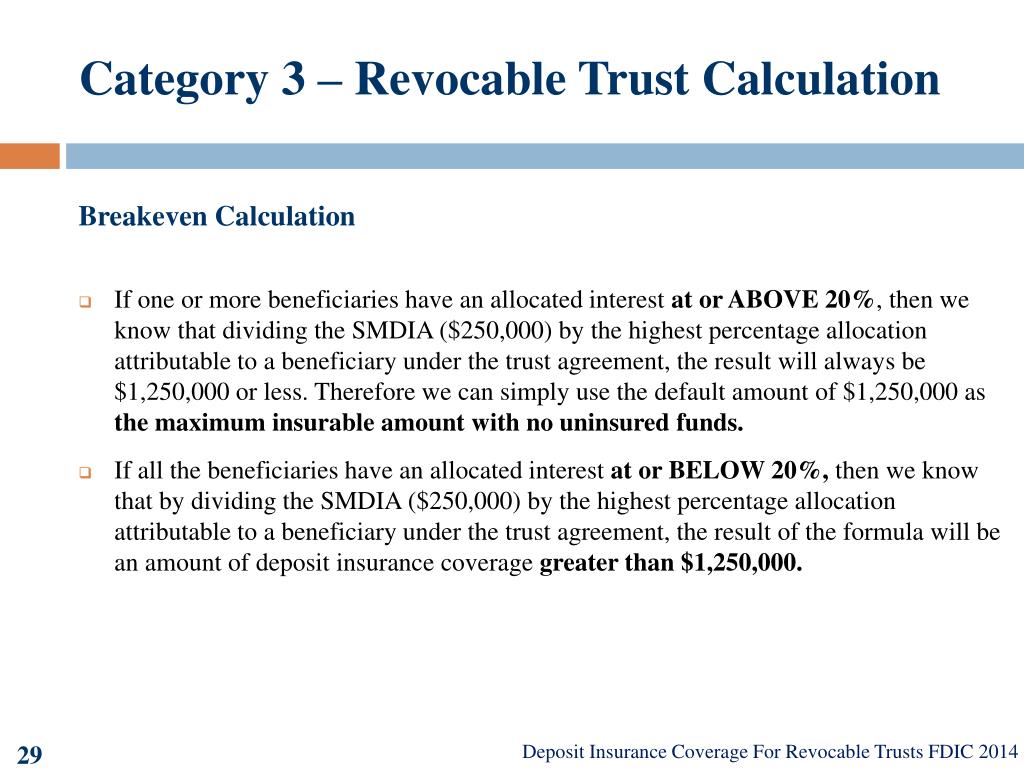

Drivers in California are required to have a minimum of 15000 per person and 30000 per accident in bodily injury liability insurance and 5000 in property damage liability coverage. And they can increase their FDIC coverage further by naming beneficiaries to their account. The FDIC says its standard is to cover up to 250000 per depositor per insured bank for each account ownership category.

The fdic which is short for the federal deposit insurance corporation is an independent agency of the united states government. Namely the 250000 limit is per account holder not per. Split Your Funds Across Multiple Banks.

Insurance coverage of a public unit account differs from a corporation partnership or unincorporated association account in that the coverage extends to the official custodian of the funds belonging to the public unit rather than the public unit itself. Top 10 Pizza In Chicago 350 Chevy Flat Top Pistons Mountain Top Walk In Clinic. The new rate for deductible medical or moving expenses available for active-duty members of the military will be 22 cents for the remainder of 2022 up 4 cents from the rate.

Here you will find an insuranceaccount calculator that will give you a breakdown on your coverage. All actual claims for deposit insurance shall be governed exclusively by information set forth in the FDIC-insured institutions records and applicable federal statutes and regulations then in effect. Lets say you have.

Electronic Deposit Insurance Estimator EDIE EDIE allows consumers and bankers to calculate your coverage on a per-bank basis determine how much is. For the hearing impaired call 800 877-8339. In other words if you have a personal checking account a personal savings account a joint checking account and a CD at your bank each of those accounts is automatically insured up to 250000.

The FDIC is changing the insurance coverage rules for mortgage servicing accounts also effective April 2 2024 to provide that accounts maintained by a mortgage servicer that are made up of principal and interest will be insured up to the 250000 limit per mortgagor borrower per institution regardless of whether those funds are paid. The FDIC wants to make sure it can cover everyone with a bank account so to make that happen it caps how much money it insures. FDIC insurance covers checking savings and other deposit accounts up to a standard amount of 250000 but there are a few caveats.

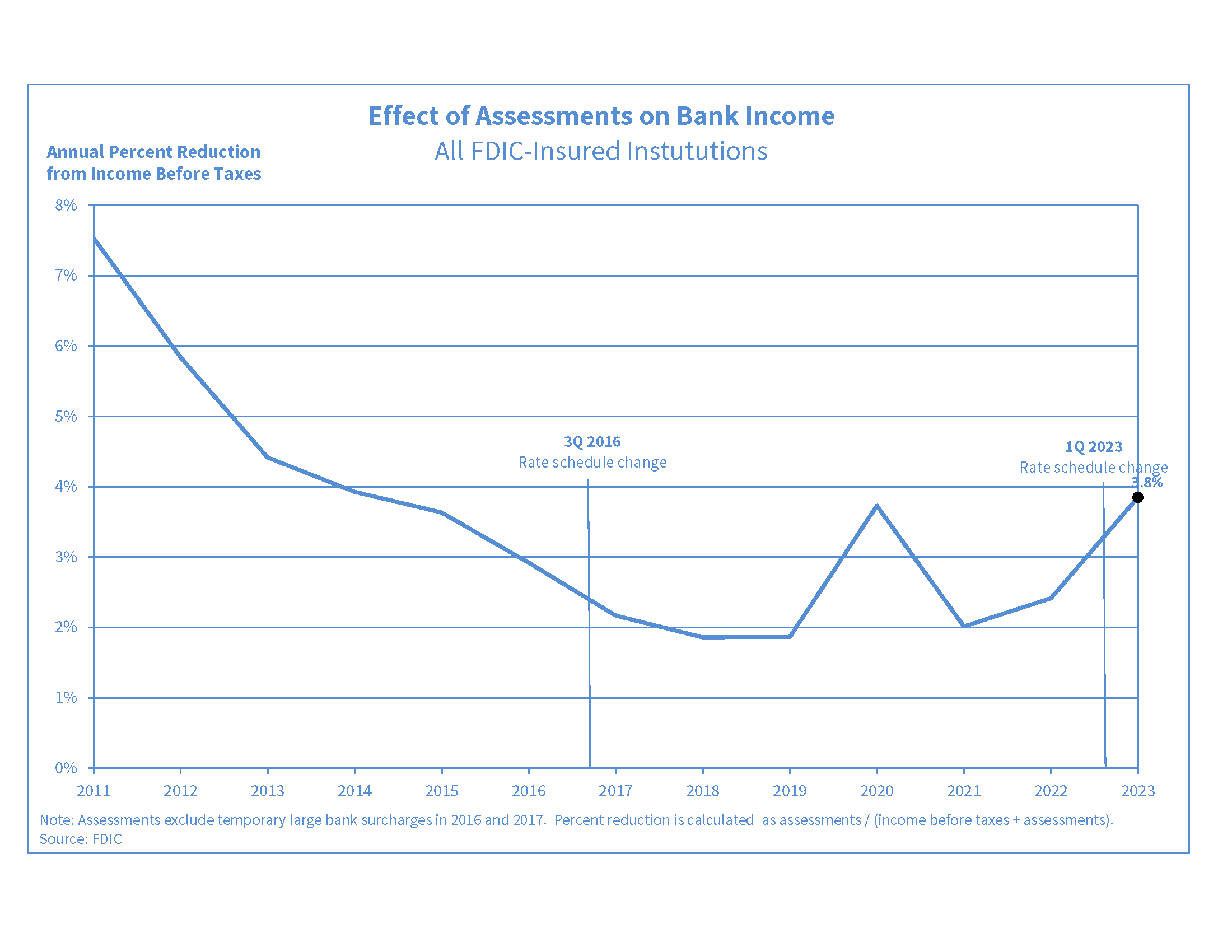

The Federal Deposit Insurance Corporation FDIC is an independent agency created by the Congress to maintain stability and public confidence in the nations financial system. Understanding FDIC insurance limits.

Fdic Seminar On Deposit Insurance Coverage For Bankers Advanced Ppt Download

Federal Deposit Insurance Corporation Wikiwand

Fdic Insurance Limits Fdic Insured Bank St Paul Mn Drake Bank

Fdic Bank Insurance Marcus By Goldman Sachs

Fdic Bank Insurance Marcus By Goldman Sachs

Fdic Bank Insurance Marcus By Goldman Sachs

Comprehensive Deposit Insurance Seminar For Bankers Ppt Download

Maximizing Your Fdic Coverage With Beneficiaries

Fdic Transparency Accountability Deposit Insurance For Bankers

Ppt Fdic May 2014 Powerpoint Presentation Free Download Id 1688719

Federal Deposit Insurance Corporation Wikiwand

Personal Finance 101 How Fdic Insurance Works Synchrony Bank

Fdic Financial Institution Employee S Guide To Deposit Insurance General Principles Of Insurance Coverage

Fdic Comprehensive Seminar On Deposit Insurance Coverage For Bankers March 23 Ppt Download

Fdic Deposit Insurance At A Glance

Advisorselect Deposit Insurance At A Glance

Ppt Fdic May 2014 Powerpoint Presentation Free Download Id 1688719

Ppt Federal Deposit Insurance Corporation Powerpoint Presentation Free Download Id 5323963